Payment testing checklist to ensure seamless transactions

According to Forbes, by 2027, it's expected that 23% of retail purchases will occur online. As of 2024, 52% of online shoppers report shopping internationally. Considering the current trends in digital and online payment, it's evident that online and in-app transactions are becoming increasingly dominant in the market. Are you interested in implementing online or in-app payment systems? If yes, testing every payment process step is important, and this checklist will help you go through payment testing as swiftly as possible. Let's begin!

We can help you drive payment testing as a key initiative aligned to your business goals

Why do you need payment testing?

Payment testing ensures that financial transactions are processed accurately, preventing errors that could cause losses or customer dissatisfaction. It maintains trust in payment systems, improving customer experience and protecting a company's reputation.

Payment testing types

Different types of payment testing can be conducted to verify the functionality and security of your payment processing system. These include:

- Functional testing: Verifies that your payment processing system works according to its design and functionality requirements.

- Performance testing: Tests the system's ability to handle high volumes of transactions without any performance degradation or downtime.

- Integration testing: Ensures that the payment processing system can integrate with other systems, such as order and customer relationship management (CRM) systems.

- Localization testing: This test measures the payment processing system's ability to operate in different languages, currencies, and regions.

- Security testing: Tests the system's security controls to identify any vulnerabilities and protect customer data.

Why do you need a payment testing checklist?

Here are a few reasons why you need a payment testing checklist:

- Ensuring accuracy: Assists in identifying and fixing errors, guaranteeing transactions are processed correctly.

- Strengthening security protocols: Helps pinpoint vulnerabilities within your payment system.

- Simplifying regulatory compliance: Streamlines adherence processes for regulations like PCI DSS.

- Cost-effectiveness: Identifies and resolves issues early on, saving time and money.

Payment testing checklist

Let's go through the key points of the payment testing checklist.

1. Payment system configuration

Setting up payment systems entails configuring payment methods, adding service providers, testing workflows, and accurately recording payment data to ensure smooth and secure transaction processing. Compliance with regulations and safeguarding customer data, alongside appropriate configuration of the payment system, improves user experience, boosts revenue, and fosters customer trust.

2. Card verification

Verifying a user's payment details is an important part of the payment process. This can include verifying cardholder information, checking for fraud signals, and setting up measures to detect and prevent fraudulent transactions.

3. Transaction processing

Once payment details are verified, payment transaction processing can begin. This includes the actual payment transfer and recording of payment data. Features like real-time transaction tracking and exception handling can help resolve issues quickly.

4. Payment security

Payment systems must be regularly monitored and updated with the latest security features. This includes features like two-factor authentication, tokenization, encryption, and other security measures that can help prevent payment fraud.

5. Transaction reports and settlement

Payment processing typically generates various reports that need to be tracked. Those reports can help businesses monitor revenue, refunds, and chargebacks and ensure accurate fund settlement.

6. Refund and chargeback handling

Sometimes, customers may issue refunds or chargebacks for various reasons, such as a faulty product or a discrepancy in payment details. Handling refunds and chargebacks promptly and efficiently is important in maintaining customer satisfaction. Payment systems should have processes to handle refunds and chargebacks quickly and effectively.

7. Currency support

Supporting multiple currencies can be a key factor in expanding a business's customer base. Depending on the payment system, however, it can be complex due to fluctuations in exchange rates and varying compliance requirements across different regions. It's important to ensure compatibility with the currencies used by your audience and be able to update currency rates in real-time easily.

8. Payment system performance

Transactions that take too long to process can lead to user and potential revenue loss. Payment systems should be designed with scalability and performance in mind. Regular testing and optimization can help ensure payment processing speed and efficiency.

9. User experience

Payment systems are often the last touchpoint for customers in an online purchasing journey. Building an intuitive and seamless payment experience is important to improve customer satisfaction. Payment systems should have clear visual cues with helpful messages, pre-filled cart details, and a smooth transition to the payment method selection and checkout pages.

10. Multi-language support

Multi-language support can be essential for a payment system, depending on the target audience and business goals. This includes the ability to display system prompts and error messages in different languages, localized payment methods, and support the different payment regulations and tax requirements of different countries. Having multi-language support can significantly improve the user experience and reduce the potential for errors.

Pro Tip

Regarding localization testing, ensure your app resonates with diverse audiences by considering Global App Testing's solutions. From linguistic accuracy to cultural adaptability, our platform streamlines the localization process, guaranteeing your app's success in global markets. We provide access to a diverse range of testers worldwide who can test payment systems in real-world scenarios.

11. Integration with CRM or accounting systems

A payment system integrated with CRM or accounting systems streamlines data reconciliation and order fulfillment processes. This can help reduce manual errors and provide real-time payment and transaction data to improve business decisions. It's important to ensure that payment systems are compatible with a variety of third-party systems and can communicate effectively with each other.

Payment testing checklist example

After reviewing the key elements of payment testing, here's an example of how the checklist should be structured.

Payment system configuration:

☐ Confirm the payment system is configured accurately.

☐ Verify that the transaction fees, payment types, and other settings are set up properly.

☐ Ensure that payment system credentials are secure and access is granted to authorized personnel only.

☐ Ensure proper payment system integration with your website/application API.

Card verification:

☐ Confirm the card verification processes are accurately set up and functioning correctly.

☐ Test both successful and failed payment scenarios for verification.

☐ Ensure your business is complying with PCI DSS requirements.

☐ Check that card data transmission is encrypted with TLS 1.2 or higher.

Transaction processing:

☐ Properly test end-to-end transaction processing by initiating and completing a settlement.

☐ Check payment responses from the systems's APIs.

☐ Conduct testing for the user acceptance criteria with customers/test accounts.

☐ Investigate and address any error responses.

Payment security:

☐ Encrypt, mask, or tokenize all customer payment data to ensure secure storage.

☐ Use secured online payment pages.

☐ Check that industry standards update security certificates and protocols.

☐ Use fraud detection measures like AVS, CVV, geo-location verification, 3D security, or other methods.

Transaction reports and settlement:

☐ Verify the accuracy of the transaction reports from the payment system.

☐ Ensure that transactions are made promptly and funds are deposited in the correct bank account.

☐ Compare transaction amounts in payment system reports to the bank statements.

☐ Conduct regular audits to detect errors or discrepancies in transaction reports.

Refunds and chargeback handling:

☐ Test refund scenarios to check how the payment system handles refunds.

☐ Confirm that any fees associated with refunds and chargebacks are handled correctly.

☐ Ensure that payment system alerts for chargebacks and refunds are timely.

☐ Prepare a chargeback handling policy and make sure your team is trained on handling chargebacks properly.

Currency support:

☐ Verify that the payment system supports all your business's currencies.

☐ Check the calculation and display of exchange rates to customers and make sure they are accurate.

☐ Test payments made in multiple currencies.

Payment system performance:

☐ Set up monitoring or alerting tools to monitor payment system performance.

☐ Ensure the payment system processes transactions within acceptable time limits.

☐ Test the payment system for performance under different loads.

☐ Ensure there are no latency or connection issues.

User experience:

☐ Conduct UI/UX testing to verify that payment system pages and workflows are user-friendly.

☐ Take customer feedback about their experience with the payment system.

☐ Analyze feedback from users to improve the payment system.

Multi-language support:

☐ Test the payment system for support for different languages.

☐ Review payment page translations for accuracy and whether they’re up-to-date.

☐ Ensure field labels and forms are accurately translated.

☐ Pay attention to the legal and compliance requirements of each country.

Integration with CRM/Accounting systems:

☐ Properly integrate the payment system with your business’s CRM or accounting system.

☐ Ensure customer information syncs correctly between systems.

☐ Test integrations between the systems to ensure transactions and data sync correctly.

Conclusion

Understanding every step in payment systems is important, as the result and user satisfaction entirely depend on the quality of payment processing. While security remains the main customer concern, the overall user experience is determined by system performance, ease of use, and the efficiency of issue resolution if problems arise. When developing a payment system, remember these factors to foster satisfied, returning customers.

How can Global App Testing assist?

Explore Global App Testing for top-notch crowdtesting services! With a vast community of over 90,000 testers worldwide and coverage in 190+ countries, we identify bugs and defects on real devices. Trusted by industry leaders like Meta, Google, Booking.com, and others, we deliver reliable and efficient testing solutions with results in just 6-48 hours. Here are some of our key features:

General features:

- Different testing platforms: We conduct testing across multiple platforms, including websites, web applications, mobile applications (iOS and Android), and many others.

- Bug reproduction: Provides validation and detailed reports on existing bugs to streamline the fixing process.

- Usability feedback: Gathers user insights to inform and prioritize enhancements in the user experience.

- Localization testing: Evaluates app performance for various international markets, ensuring local relevance and compliance.

- The Global App Testing platform: Easy-to-use testing platform with detailed bug reports, test case results, and qualitative insights and reports.

- Usability testing: Assess user experience diversity.

- Web app testing: Ensure web app quality.

- Mobile app testing: Validate mobile app compatibility.

- Accessibility testing: Ensure inclusive design.

- Functional testing: Verify key functions.

- Exploratory testing: Rapid ad hoc tests.

- Regression testing: Tailored QA assurance.

- API Integration: Integrate your CI with our API, CLI, and Webhooks.

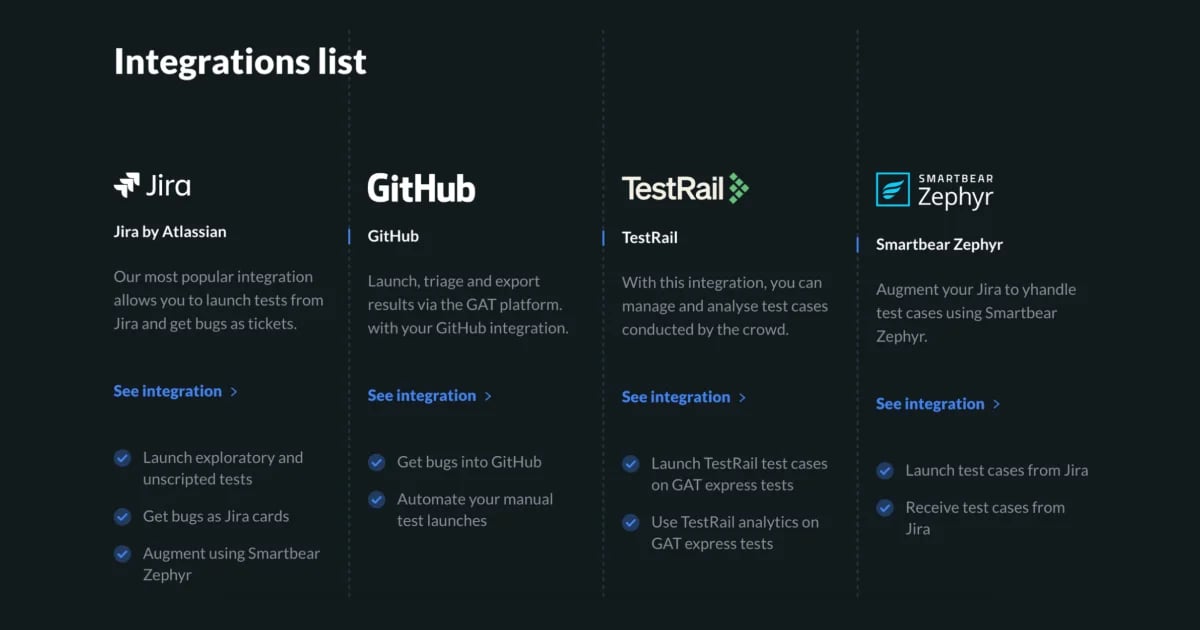

- Project management tools: Integrate with popular tools such as Jira, GitHub, TestRail, and others to streamline testing processes and manage tasks efficiently.

Are you interested in learning more? Sign up, and schedule a call with our specialist today!

We can help you drive payment testing as a key initiative aligned to your business goals

FAQ

How do you test a payment?

Testing a payment involves verifying various aspects, such as payment methods' functionality, transaction processing accuracy, security measures compliance, and handling different scenarios, such as successful transactions, declined transactions, and refunds.

How do you write a test case for a payment page?

Writing a test case for a payment page involves defining test scenarios covering all payment process elements, including input validation, payment method selection, transaction processing, error handling, and confirmation messages. Each test case should specify preconditions, execution steps, expected results, and validation criteria.

How do you automate payment testing?

Payment testing can be automated using specialized automation tools and frameworks that support payment gateway integration testing. This involves scripting test cases to simulate various payment scenarios, including successful and failed transactions, and leveraging APIs to interact with payment gateways programmatically.

Keep learning

What is performance testing and how does it work?

Transaction flow testing techniques in software testing

What is payment gateway testing? Everything to know